Comprehensive Forex Trading Tutorial for Beginners

Forex trading is an exciting and potentially lucrative way to invest in the financial markets. For novices, the landscape may seem intimidating, but with the right guidance and educational resources, anyone can learn the fundamentals of currency trading. In this tutorial, we will explore the basics of Forex trading, including terminology, strategies, tools, and tips for finding reputable brokers such as forex trading tutorial Uzbekistan Brokers.

1. Understanding Forex Trading

Forex, or foreign exchange, is the market where currencies are traded. It operates 24 hours a day, five days a week, making it one of the most accessible financial markets in the world. The Forex market is decentralized, which means that it does not have a central exchange; instead, trading occurs between parties over-the-counter (OTC).

2. Key Terminology

Before diving into trading, understanding key terminology is essential. Here are some critical terms you should know:

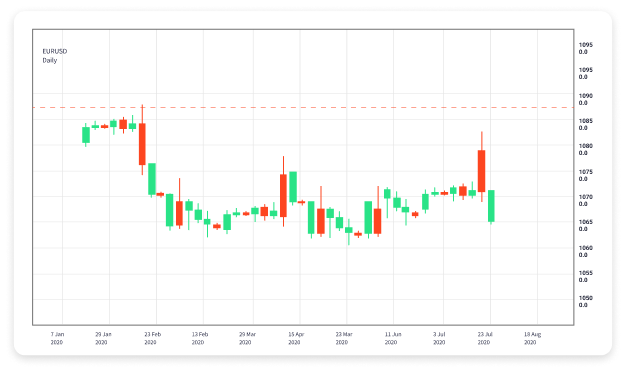

- Currency Pair: A quotation of two different currencies, where one currency is exchanged for another, e.g., EUR/USD.

- Pip: The smallest price movement in a currency pair, often 0.0001.

- Lot: A standardized unit of measurement for Forex trades, typically 100,000 units for a standard lot.

- Spread: The difference between the bid and ask price of a currency pair.

- Leverage: The ability to control a large position with a relatively small amount of capital, magnifying both potential profits and risks.

3. Choosing a Broker

When starting with Forex trading, choosing the right broker is crucial. A good broker offers a user-friendly trading platform, competitive spreads, and reliable customer service. Moreover, ensure that they are regulated by reputable financial authorities to secure your investments. You can explore various options, including local Uzbekistan Brokers that may suit your trading needs.

4. Opening a Trading Account

Once you’ve chosen a broker, the next step is to open a trading account. Most brokers offer different types of accounts tailored for beginners, experienced traders, or institutional investors. Make sure to provide the necessary documents to verify your identity and complete the registration process.

5. Analyzing the Market

Successful Forex trading relies heavily on market analysis. There are two main types of analysis that traders use:

- Fundamental Analysis: This involves analyzing economic indicators, news releases, and geopolitical events that may affect currency values.

- Technical Analysis: This approach uses historical price charts and technical indicators to forecast future price movements.

6. Developing a Trading Strategy

Having a trading strategy is vital for your success in Forex trading. A strategy helps you make decisions based on research and analysis rather than emotions. Some popular trading strategies include:

- Scalping: Making numerous trades within a day to capitalize on small price movements.

- Day Trading: Opening and closing positions within the same trading day to avoid overnight risks.

- Swing Trading: Taking advantage of price swings over several days or weeks.

- Position Trading: Long-term trading based on fundamental analysis.

7. Risk Management

Risk management is an integral part of trading that involves strategies to minimize potential losses. Here are some essential tips:

- Use stop-loss orders to limit losses.

- Only risk a small percentage of your trading capital on a single trade (1-2% is common).

- Diversify your trades to spread risk.

- Keep emotions in check to avoid overtrading.

8. Practice with a Demo Account

Before investing real money, many brokers offer demo accounts that allow traders to practice trading without financial risk. This is an excellent way to familiarize yourself with the trading platform and test different strategies in real-market conditions.

9. Executing a Trade

Executing a trade in Forex involves selecting the currency pair, analyzing the market, choosing the trade size (lot), setting stop-loss and take-profit orders, and placing the trade. Monitoring your trades and adjusting them according to market dynamics is also crucial.

10. Keeping a Trading Journal

Maintaining a trading journal is a great practice for any trader. Record all your trades, including entry and exit points, the strategies you used, and the outcomes. This will help you learn from your successes and mistakes, enabling you to refine your trading strategies.

Conclusion

Forex trading offers opportunities for anyone willing to learn and practice. By understanding the fundamentals, developing a solid trading strategy, and managing risk effectively, you can work towards becoming a successful trader. Remember to stay updated with market trends, keep refining your skills, and leverage tools like demo accounts and trading journals to enhance your trading journey.